Budget Allocation Methods for Growing Businesses

A structured program designed to help finance professionals and business owners understand practical approaches to distributing resources across departments, projects, and growth initiatives.

Our next cohort begins in October 2025. Applications are reviewed on a rolling basis, and we encourage early submission as spaces fill quickly. This isn't about overnight transformation—it's about building a solid foundation in financial planning that takes time to develop and apply.

Core Learning Modules

We've broken down the curriculum into focused modules. Each one builds on the previous, so you're not jumping around trying to connect dots that don't make sense yet.

Understanding Budget Frameworks

Start with the basics—what different budget models exist, when to use each one, and what works for different company sizes. You'll look at zero-based budgeting, incremental approaches, and activity-based methods through real examples.

Data-Driven Allocation Decisions

How do you decide where money goes? This module covers analyzing historical spending, forecasting future needs, and using metrics to justify budget requests. You'll practice with actual datasets from various industries.

Cross-Department Coordination

Budgeting doesn't happen in a vacuum. Learn how to work with different departments, manage competing priorities, and communicate financial constraints without becoming the person everyone avoids at meetings.

Scenario Planning and Adjustments

Things change. Markets shift, costs increase, opportunities arise. This section focuses on building flexible budgets that can adapt, creating contingency plans, and knowing when to reallocate resources mid-year.

Review and Optimization Cycles

Budgets need regular check-ins. You'll learn to set up review schedules, identify variances that matter, and make adjustments based on performance data. Plus, how to present findings to stakeholders who may not love spreadsheets.

Long-Term Strategic Alignment

Connect annual budgets to broader business goals. This module ties everything together, showing how short-term allocation decisions support multi-year objectives and growth plans.

How the Program Actually Works

We're not fans of endless video lectures where you zone out halfway through. Instead, sessions run twice weekly with live discussion, case study analysis, and time to work through problems with guidance available when you're stuck.

Between sessions, you'll apply concepts to your own organization's budget scenarios. This isn't hypothetical—you're working with real numbers, real constraints, and real challenges from your current role.

Live sessions scheduled for Tuesday and Thursday evenings (Central European Time) to accommodate working professionals across Germany and neighboring regions.

Small cohorts of 12-15 participants allow for actual conversation and specific feedback on your budget challenges, not generic advice.

Access to templates, calculators, and frameworks used by mid-sized companies in manufacturing, services, and technology sectors.

Optional peer review sessions where participants share their budget proposals and get constructive feedback from others facing similar allocation dilemmas.

Annika Bergström

Former CFO at a Frankfurt-based logistics company, now teaching the budgeting methods she used to scale operations from 50 to 200 employees.

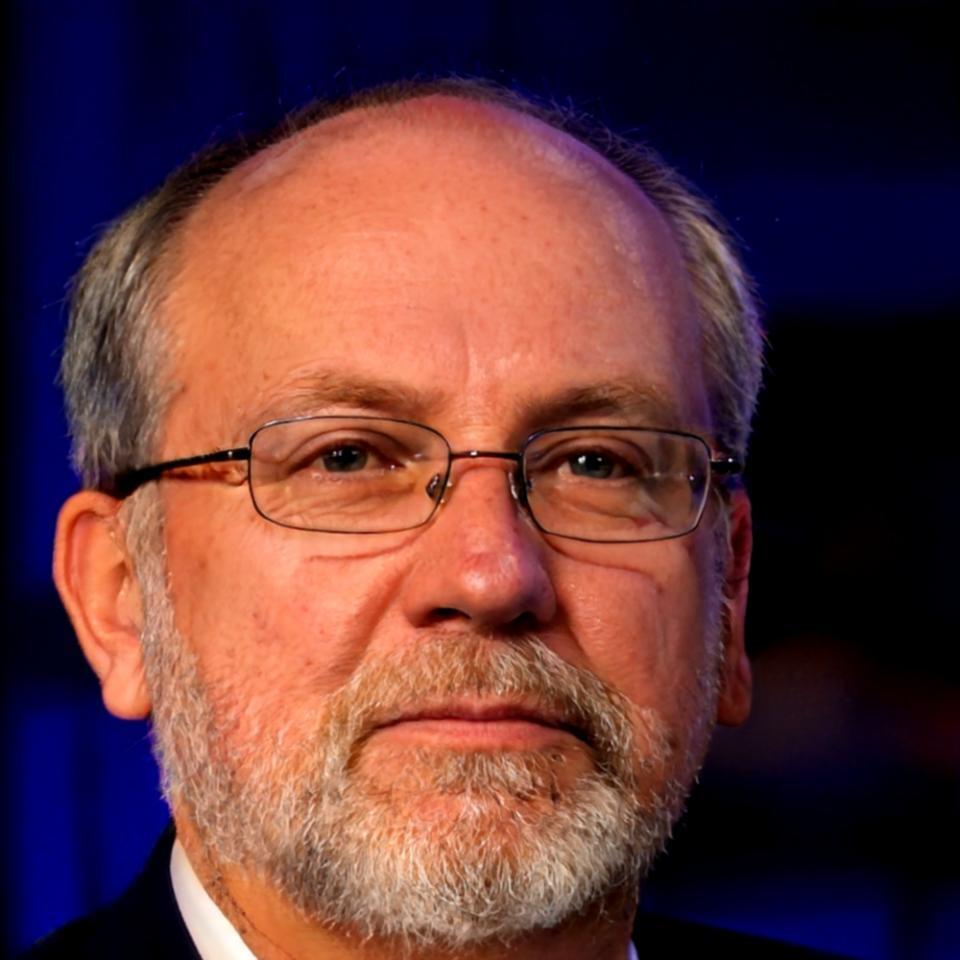

Henrik Wolff

Spent eight years in corporate finance at manufacturing firms, specializing in capital allocation and departmental budgeting during growth phases.

Mira Seidel

Consultant who's worked with over 30 companies on budget restructuring, particularly in technology and professional services sectors.

Who Guides the Program

Our instructors come from operational finance roles—not academia. They've built budgets under pressure, defended allocation decisions to skeptical executives, and dealt with the reality of limited resources and unlimited requests.

Each brings a different industry perspective, which matters because budget challenges look different in manufacturing versus services versus tech companies.

During live sessions, at least one instructor is present for questions. You're also assigned a primary contact who reviews your applied work and provides written feedback on your budget proposals.

Program Timeline and Structure

The program runs for 14 weeks starting October 2025. That's about three months of twice-weekly sessions, plus independent work applying concepts to your organization.

Weeks 1-3: Foundation Building

Cover different budget methodologies, understand when each approach makes sense, and begin analyzing your current organization's budget structure. You'll also get familiar with the financial modeling tools we'll use throughout.

Weeks 4-7: Practical Application

Start building or refining budget models for your organization. Work through case studies from companies similar to yours, participate in allocation simulations, and learn to justify budget decisions with data rather than just gut feeling.

Weeks 8-11: Advanced Scenarios

Handle the messy parts—sudden cost increases, unexpected opportunities, department conflicts over resources. Practice scenario planning and develop contingency budgets. This is where theory meets reality.

Weeks 12-14: Presentation and Review

Present your complete budget proposal to the cohort and instructors. Receive detailed feedback and learn from others' approaches. Final sessions cover ongoing optimization and how to maintain effective budget processes long-term.

Applications for our October 2025 cohort are being accepted through August. Space is limited to maintain the quality of interaction and feedback.

Request Program Information